Micropayments, as the name suggests, are transactions involving small amounts of money – ranging from less than a cent to around five to 20 US dollars, usually done electronically.

Micropayments are an integral part of today’s subscription services and in-app payments. It is not a new idea. The concept has existed since the nineties. The first generation micropayments that date back to mid-late nineties failed to produce any tangible results.

Second generation micropayments have evolved since 2010 with the advent of online subscription services.

However, many factors, technological and economical, have hindered its widespread adoption. But, the dawn of Blockchain technology and the growing adoption of crypto and digital currencies have solved many of the longstanding issues with micropayments, leading to its increased acceptance.

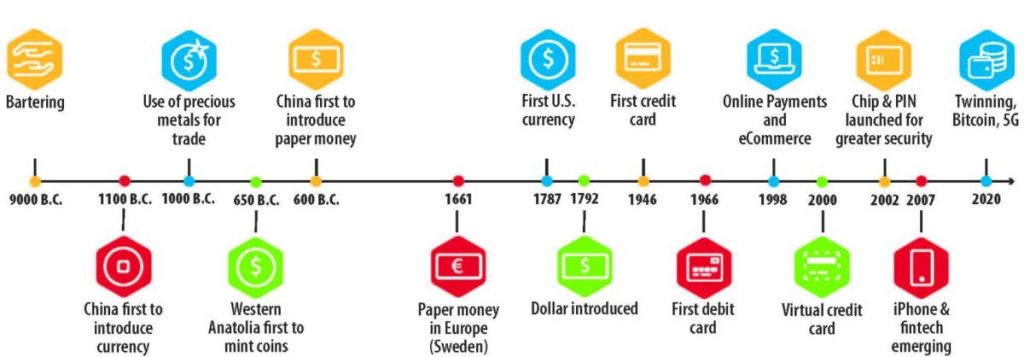

Evolution of Payments

Paying for goods and services in cash or kind has existed for centuries, since the barter system in 9000 B.C. With the advent of online payments in the last decade of the 20th century, a new concept became popular – Micropayments.

Though micropayments commonly refer to online payments made in small amounts, the word existed decades before the World Wide Web. Ted Nelson, an American sociologist, and pioneer of information technology, first coined the phrase micropayment in 1960.

Nelson formulated the concept of micropayments as a potential mechanism for royalty payments to the authors of the then-nascent online publishing.

In the late 1990s, World Wide Web Consortium (W3C) started creating the standards for embedded micro-transactions requests along with the ‘402 Payment Required‘ HTTP error code.

However, the W3C did not continue its efforts in the area, and soon the concept of embedded micropayments fizzled out.

First generation micropayments

First-generation micropayments were an anachronism as the Internet and e-commerce had not yet matured to reap the benefits of micro-transactions.

For instance, Digicash, founded by David Chaum in 1998, was a form of electronic payment that allowed users to anonymously make small fiat payments by using cryptographic methods.

The company struggled to increase its user-base and eventually filed for bankruptcy, citing the immaturity of e-commerce systems as the reason.

Also read: 100 Best TV Shows & Movies On Tubi To Stream Without Paying Credit

Second generation micropayments

Micropayments garnered interest again in 2010 with the advent of the digital subscription model. Various online service providers – publications, video, and gaming services – were exploring options to attract customers to use their digital services.

Consumers found the paywall model where they pay monthly, quarterly, or yearly fees to access the offered content, very attractive. Companies employing this model gained significant growth both in the number of subscribers and in their revenue.

In the first quarters of 2020, the New York Times reportedly added 587,000 new digital subscriptions with the digital subscription business revenue accounting for over 46 percent of the total subscription revenue.

Similarly, in 2019, the streaming service, Netflix increased its subscription revenue by over 1000 times from that a decade ago.

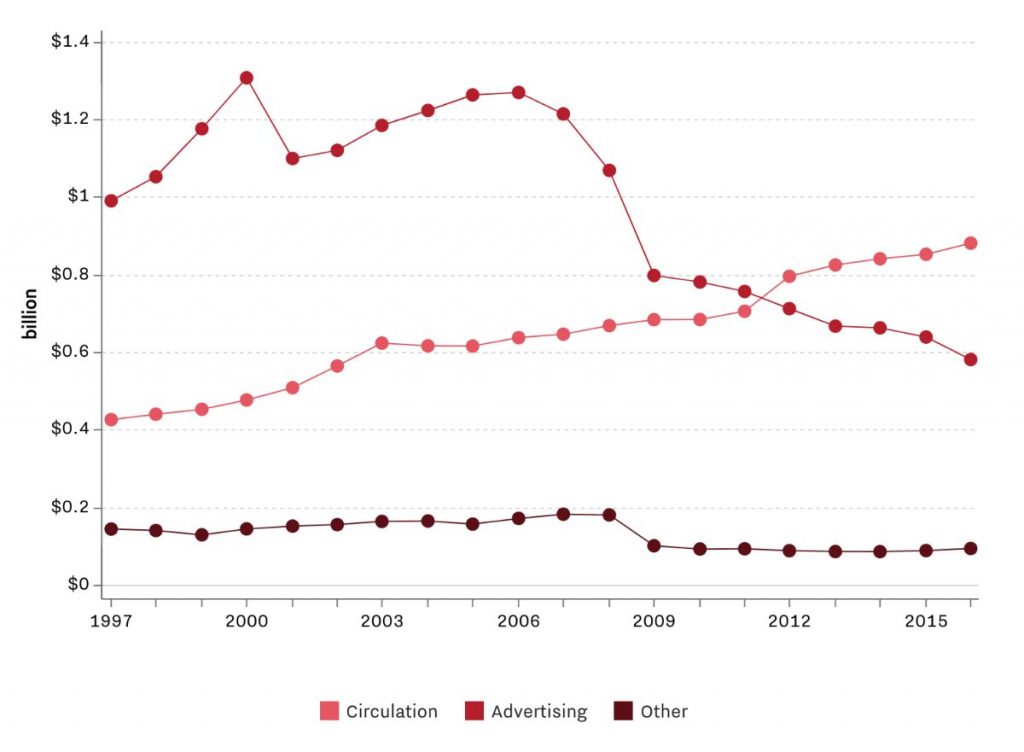

This revenue eventually surpassed the revenue generated from other streams. By 2012, the subscription revenue of the New York Times exceeded its advertising revenue and has continued to exceed since.

Problems with the subscription model

But, consumers do not always find the subscription model lucrative. Often users are unable to read all the subscribed articles in a week or watch all the subscribed online content in a month.

Consequently, they end up paying more than what they can consume. In the whitepaper titled, Micropayments and Mental Transaction Costs, Nick Sabo states that when the consumers feel they are paying more for the services they use, their mental transaction costs mount up.

Eventually, the cumulative costs will dissuade the consumers from continuing the subscribed services.

What-if instead of paying $4 for all inclusive access, the user gets to pay less than a cent for every page they read or for every minute of the streaming content they watch?

A payment option where the users have to pay only for what they consume sounds more attractive to them and hence reduce their mental transaction costs. The service providers will have lesser churn rates as consumers tend to stick with the subscription for longer.

Also read: How To Make $5000 In A Month? 20+ Easy Ways To Make 5K Dollar Fast + Tips!

Service providers’ take on fiat micropayments

However, digital content providers do not always benefit from this à la carte model. Firstly, the vendors find it too expensive to invoice individual payments.

The fees they need to pay the banks and payment processors for facilitating transactions would be higher than their earnings. For instance, while Visa charges around 1.5 percent plus $0.10 for every swipe of the customer’s credit card, Paypal, Amazon, and Stripe charge 2.9 percent plus $0.30 per transaction.

Secondly, for the startups in this space, the capital is usually limited, and high transaction fees often results in delayed profitability. Increased expenses for cash-crunched startups often put them out of business.

Thirdly, if the consumer has to go through the hassle of setting up an account for the one article they read, they might not return to the website. Finally, these micropayments enormously increase the transaction volumes, thereby clogging the payment networks.

How can Blockchain handle micropayments?

To begin with, instead of paying two to three cents in fiat money and incurring high transaction fees, users can buy cryptocurrencies with that money. They can then use the fractions of crypto to pay for the service.

Additionally, the smallest denomination of a US dollar is a cent and amounts to $ 0.01, whereas that of a bitcoin is a Satoshi, which is 0.00000001 bitcoin. Hence, smaller micropayments are feasible with crypto.

But, there is still a transaction fee to purchase crypto with fiat. For instance, Coinbase charges varied transaction fees depending on the amount, $1.99 for transactions up to $10, $2.99 for transactions up to $200, etc.

Secondly, the crypto wallets can be integrated into the browsers and used to pay for the services. The websites requesting payments connect to these embedded wallets, and users can pay without setting up accounts on every website.

Finally, the underlying Blockchain platform is a significant value-add to the micropayments market. Using Blockchain, users can produce verifiable authentication claims and share only the required information with the vendors.

Meanwhile, the users can use Blockchain to monitor the usage of their personal data and control who they share this information with. They can even monetize every time they choose to share their information.

Mechanisms such as Zero Knowledge Proofs enable people to share their information without the data being pursued by unintended parties.

Challenges with crypto micropayments

Yet, some challenges do exist. Firstly, in some Blockchain applications such as Bitcoin, the transaction confirmation time is very high. A customer or a vendor cannot wait for an hour for the transaction to be processed. Slower processing time increases the risk of double-spend.

Secondly, the volume of such micro-transactions will usually be high, and many Blockchain applications are currently incapable of handling such high volumes. Hence, it is vital to resolve the speed and scalability issues for the acceptance of crypto as micropayments.

Also read: [10 BEST] AI Influencer Generator Apps Trending Right Now

Are crypto micropayments widely accepted today?

According to coinmap.org, there are over 15,000 businesses accepting cryptocurrencies, specifically bitcoins as payment options, an increase of 34 percent since 2017. Wikipedia allows its patrons to make small donations in bitcoin.

The live-streaming platform, Twitch, offers its users a discount of 10 percent on subscription fees paid using cryptocurrency. NBA teams, Sacramento Kings and Dallas Mavericks, accept bitcoins as payment for game tickets and merchandise.

A Blockchain startup, Civic, has crypto-enabled vending machines. These machines allow users to pay in small denominations using a QR code to buy anything from a pack of chips to alcohol. Also, using Blockchain technology, these machines can ascertain the legal age of the buyer of age-restricted purchases such as alcohol.

Global payments companies – Mastercard, Visa, and Paypal are also venturing into the cryptocurrency marketplace. They are collaborating with several cryptocurrency firms to add cryptocurrency payments on their platforms.

Meanwhile, Eftpos, Australia’s leading point-of-sale technology provider, is launching a proof-of-concept exploring DLT-based micropayments using stablecoin pegged on Australian Dollar.

In conclusion, the increased mainstream adoption of Blockchain and cryptocurrencies will benefit micropayments while resolving many of its longstanding problems.

Top 10 News

-

01

[10 BEST] AI Influencer Generator Apps Trending Right Now

Monday March 17, 2025

-

02

The 10 Best Companies Providing Electric Fencing For Busines...

Tuesday March 11, 2025

-

03

Top 10 Social Security Fairness Act Benefits In 2025

Wednesday March 5, 2025

-

04

Top 10 AI Infrastructure Companies In The World

Tuesday February 11, 2025

-

05

What Are Top 10 Blood Thinners To Minimize Heart Disease?

Wednesday January 22, 2025

-

06

10 Top-Rated AI Hugging Video Generator (Turn Images Into Ki...

Monday December 23, 2024

-

07

10 Top-Rated Face Swap AI Tools (Swap Photo & Video Ins...

Friday December 20, 2024

-

08

10 Exciting iPhone 16 Features You Can Try Right Now

Tuesday November 19, 2024

-

09

10 Best Anatomy Apps For Physiologist Beginners

Tuesday November 12, 2024

-

10

Top 10 Websites And Apps Like Thumbtack

Tuesday November 5, 2024